This is a sponsored conversation written by me on behalf of Our Life Covered℠… all expressed thoughts, opinions and content were written by me at Hello Happiness and reflect my beliefs. It is brand partnerships like these that I am proud to work on, which continue to make this blog possible. This article is for informational purposes only and not intended to provide any specific financial advice.

Let’s get serious for a minute… the older we get, the more we should start thinking about protecting not only ourselves, but our loved ones–here comes the mid-30 something mama out in me friends! It’s been an amazing start to this brand new year so far… this empowerment movement of all things WOMEN so this subject is only fitting for us to discuss, especially when so many of us are trying to be supermoms in everything we do–from the carpool line to how we pack lunches to dressing our kids to birthday parties [and on and on and on and on, am I right?!?!]. And yes, I am completely guilty of all of these things too, I assure you. Say hello to Our Life Covered, created for women BY women. With a goal to make it easy for women to shop AND apply for life insurance, they seek to make sure people have the right life insurance coverage in place… not only to protect their legacy, but to ensure their family is taken care of if the unexpected were to happen. Let’s face it, I speak to that topic with my close friends + family all the time, but I think it’s a must to share my thoughts on this ever important topic with all of my blogging friends as well… I’ve had these conversations with so many of my girlfriends and no, it’s not light-hearted, but it’s a necessity and something we need to plan out for the “just in case”. Life isn’t guaranteed, but two things are: death and taxes and we need to be prepared for the unforeseen stuff and plan it out right… Our Life Covered takes the guesswork out of shopping for insurance and they make it easy–completely online OR by contacting one of their agents over the phone. This is when I am thankful I am married to someone who loves to plan and knows how important insurance is… we sat down years ago and formulated our life insurance plans based on possible scenarios given our family’s health histories, and even talked through those “what if” situations so that we’d be prepared no matter what. Click here to read Four Things You May Not Know About Life Insurance… I found it crazy to think of how much we pay for cell phone insurance, but how little we think and/or acknowledge the importance of insurance for ourselves. Need some clarification about life insurance?? Trust me, when we started buying our life insurance policies almost 10 years ago, I had a ton of questions too and I SO wish I had a resource like this to help calm my fears and answer all my nagging questions. Read Insurance 101–it’s like a speed dating session of all the high-level lingo and need-to-knows! P.S. you may also find out that life insurance can actually be REALLY inexpensive to purchase, especially when you’re young + healthy [like all of you young professionals reading this] so start NOW.

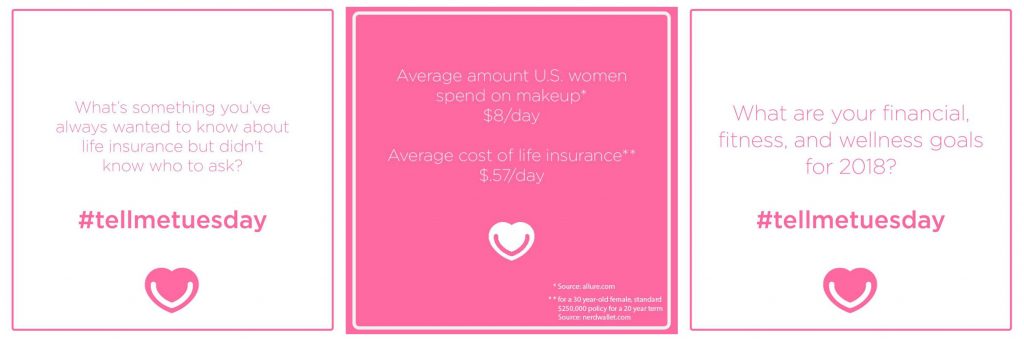

They also have a #TellMeTuesday conversation on their Facebook page where you can ask questions and learn more about life insurance… simple and oh so helpful and this is when modern technology makes me happy = instant access and guidance. We are all about positive changes and impacts to our well-being, health and life since it’s a brand new year, and this is one topic that should top your list… small changes add up to big results. Like the graphic above which shows how on average women spend $8/day on makeup, and the average cost of life insurance is just .57/day. It’s all about perspective, right?!?! I’ll be honest=that number hit home for me as I don’t think twice about the lipstick I buy, but it just demonstrates how inexpensive it really can be and I can forego a few things to help my family in the long run.

Want to learn more and get a personalized quote?? Visit here and enter in your birthday, answer a few extra questions and get a quote. Even if you aren’t a parent, you’re likely to reach a milestone in your life where you’re going to want to plan for life insurance, like getting married OR buying a home… get smart and get covered!

This is a sponsored conversation written by me on behalf of Our Life Covered. The opinions and text were created by me and reflect my beliefs.

Be the first to comment